Category Archives: economy

Why India is key to 21st century multilateralism

Four watershed events since 2020 — a short period, but with apologies to Lenin, decades have happened in this time — have established India’s credentials as one of the last major bulwarks of a rules-based order, open and fair trade and economic arrangements, and the rule of law. These are critical elements if we are to build a new world order that is balanced, inclusive and fair.

The first event was the capitulation of western powers in Afghanistan. The triumph of the Taliban was not a victory by just war but the defeat of a people by deceit. Liberals around the world were kept in the dark as a Faustian bargain was struck by major powers that sought expediency over ethical diplomacy. Today, American supporters of the infamous Doha Agreement — ironically called the Agreement for Bringing Peace to Afghanistan — express concern about Afghan women. Their hypocrisy is naked and jarring. The Doha deal could never have turned out any differently. India kept a principled distance from that pernicious deal. Appreciating fully the true nature of a prospective Taliban regime, it continued to seek an elected and pluralist government in Kabul. India was a lone voice. Yet it did not compromise. Today, India continues to support the people of Afghanistan without recognising the regime that tyrannises it.

American supporters of the infamous Doha Agreement — ironically called the Agreement for Bringing Peace to Afghanistan — express concern about Afghan women.

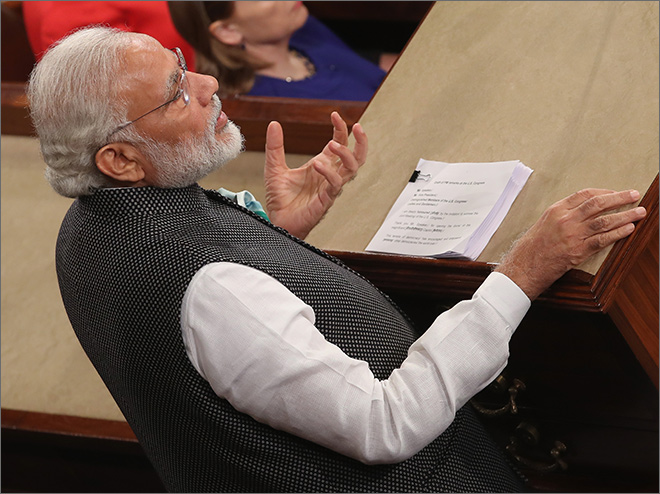

The second is the war in Ukraine. The measures and countermeasures by Russia and Ukraine have resulted in bloodshed and mayhem, ultimately perpetuating the conflict. India’s position of principled independence, while advocating cessation of violence and pursuit of diplomacy, is recognised as the only meaningful way forward. The Indian stance has resonated across the G20 and beyond. The G20 Bali Leaders’ Declaration echoes Prime Minister (PM) Narendra Modi’s approach when it speaks of the “need to uphold ….. the multilateral system that safeguards peace and stability”, the importance of “peaceful resolutions of conflicts”, and the vital role of “diplomacy and dialogue”. Furthermore, India has consistently argued for respect for sovereignty and investigation of crimes against humanity, including those possibly committed by the Russian army.

Third, in the technology domain, India has long championed an open, free and fair digital order. However, with the United States (US) pressing for narrow benefits for Silicon Valley in the past decade, India was reluctant to endorse instruments that sought free data flow without sufficient accountability from actors responsible for storing and transporting such data. Much to the US’s chagrin, India appeared to restrict cross-border data flows, sought regulation of non-personal data and contested monopolies, and restricted cartelisation attempts of the US’s payments and e-commerce companies. It made no secret of its distrust. Having dispelled coercive pressure to enter into digital handshakes on unfavourable terms or sovereign commitments on a future digital services tax, India has now eased its stand on data localisation. The reason: There is no longer any pressure from the US because even domestic actors in America want greater regulation and accountability from Big Tech. India is exploring sharing data with “trusted geographies” while seeking surgical data protection for specific sectors. An inclusive, equitable internet remains a core priority.

With the United States (US) pressing for narrow benefits for Silicon Valley in the past decade, India was reluctant to endorse instruments that sought free data flow without sufficient accountability from actors responsible for storing and transporting such data.

The year 2021 signalled India’s fourth landmark moment. At the 26th round of the Conference of the Parties (COP26), India demonstrated extraordinary commitment to the planet by announcing its goal of reaching net-zero by 2070. It voluntarily imposed on itself a timeline for climate action, although its emissions per capita were well under two tonnes – about one-eighth those of the US. PM Modi’s Panchamrita road map for 2070 includes interim targets for boosting non-fossil energy capacity, using renewables, and reducing carbon emissions and the economy’s carbon intensity. PM Modi also later launched India’s LiFE (Lifestyle for Environment) Mission. He emerged as one the earliest world leaders to state candidly that climate action would require changes to individual lifestyles, taking steps to initiate those changes. By contrast, an international survey of 10 countries, including the US, the United Kingdom, France and Germany — published to coincide with COP26 — found few citizens willing to make significant lifestyle sacrifices. In fact, 46% of respondents believed there was no real need for them to do so. Take the facile but heated domestic debate around a potential ban on gas stoves in the US. Even as US diplomats have long championed “clean cookstoves” for the developing world, it appears there is little interest in following good climate practices at home.

India’s natural influence as a democracy and sincere interlocutor that can engage the political spectrum of nations gives it unique moral authority. Indeed, 21st century multilateralism needs more Indias. The G20 — with its mix of developing and developed countries — offers the perfect platform for India to infuse partner nations with foundational ideas. The world has much to learn on putting humanity first, adopting a pro-planet orientation, promoting peace, and placing equity and inclusion at the heart of internationalism. With its ethos of One Earth, One Family, One Future, India could show the way.

Setting a path to green, resilient and inclusive development

Co-Authored with Mari Elka Pangestu

By investing now to build a green, resilient and inclusive economy, countries can turn the challenges of COVID-19 and climate change into opportunities for a more prosperous and stable future.

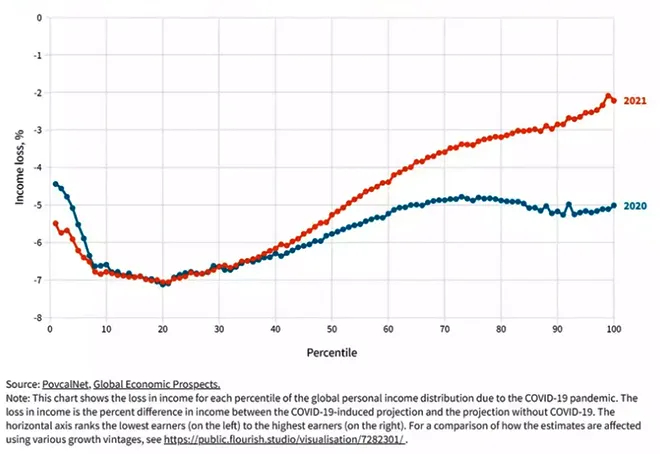

The decade following the 2009 global financial crisis was characterised by growing structural weaknesses in developing countries, which have been further aggravated by the COVID-19 pandemic and climate change, worsening poverty and inequality. These weaknesses include slowing investment, productivity, employment, and poverty reduction; rising debt; and accelerating destruction of natural capital. The pandemic has already pushed over 100 million more people into extreme poverty and worsened inequality. The effects of climate change are expected to push an estimated additional 130 million people into extreme poverty by 2030.

COVID-19 and climate change have starkly exposed the interdependence between people, the planet, and the economy. All economic activities depend upon ecosystem services, so depleting the natural assets that create these services, eventually worsens economic performance.

The decade following the 2009 global financial crisis was characterised by growing structural weaknesses in developing countries, which have been further aggravated by the COVID-19 pandemic and climate change, worsening poverty and inequality.

Figure 1: Global income losses due to the COVID-19 pandemic

A business-as-usual recovery package that neglects these interlinkages would not adequately address the complex challenges that confront the world nor its structural weaknesses and would likely result in a lost decade of development. Targeting socioeconomic, climate change and biodiversity challenges in isolation is likely to be less effective than a coordinated response to their interacting effects. A continuation of current growth patterns would not address structural economic weaknesses and would erode natural capital and increase risks that affect long run growth. As the depletion of forests, oceans, and other natural assets worsen, the cost of inaction is becoming more expensive than the cost of climate action and it is the poor and vulnerable who are most disadvantaged by it.

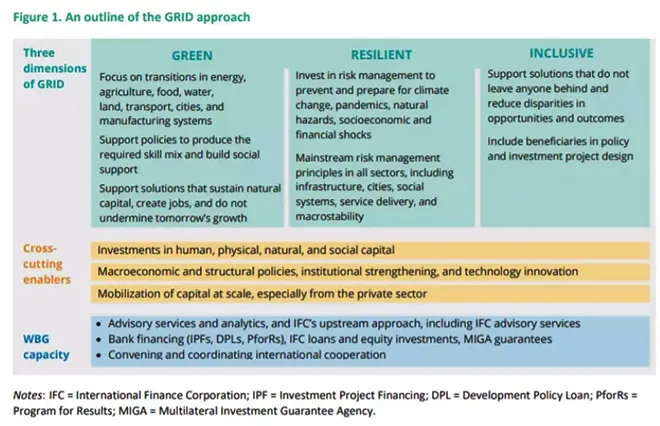

The GRID approach

The solution is to adopt a Green, Resilient and Inclusive Development (GRID) approach that pursues poverty reduction and shared prosperity with a long-term sustainability lens. This approach sets a recovery path that maintains a line of sight to long-term development goals; recognizes the interconnections between people, the planet, and the economy; and tackles risks in an integrated way. Research from the University of Oxford, World Economic Forum and Observer Research Foundation has all shown that a green recovery will not just be beneficial for combating climate change but also offer the best economic returns for government spending and yield development outcomes. The GRID approach is novel in two respects.

First, though development practitioners have long worried about poverty, inequality and climate change, the GRID approach pays particular attention to their interrelationships and thus, on the cross-sectoral nature of critical development policies. Second, achieving GRID implies simultaneously and systematically addressing sustainability, resilience and inclusiveness. GRID is a balanced approach focused on development and sustainability and tailored to each country’s needs and its Nationally Determined Contributions (NDC) objectives. Such a path will achieve lasting economic growth that is shared across the population, providing a robust recovery and restoring momentum on the Sustainable Development Goals (SDGs).

Research from the University of Oxford, World Economic Forum and Observer Research Foundation has all shown that a green recovery will not just be beneficial for combating climate change but also offer the best economic returns for government spending and yield development outcomes.

Recovering from COVID-19 with GRID

The pandemic has inflicted a particularly harsh blow on developing economies. Most urgently, a fast and fair vaccine rollout is critical to an L-shaped recovery. Vaccine access and deployment presents challenges unprecedented in scale, speed and specificities, which will require strong coordination.

Looking ahead, setting a path to GRID will require urgent investments at scale in all forms of capital (human, physical, natural, and social) to address structural weaknesses and promote growth. Special attention is needed on human capital development to rebuild skills and recover pandemic related losses, especially amongst marginalised groups. While the pandemic has amplified the challenges of providing education for all, it has also highlighted how disruptive and transformational technologies can be leveraged in addition to traditional in person learning to help education services withstand the unique pressures of this time.

Recovery packages are an opportunity to prioritise investments in the infrastructure needed to develop and roll out transformative technologies.

Women must be at the center of the GRID agenda as powerful agents of change. Education for girls, together with family planning, reproductive and sexual health, and economic opportunities for women will accelerate the green, resilient and inclusive dimensions of development.

Technology and innovation will play an essential role in promoting low carbon growth. Recovery packages are an opportunity to prioritise investments in the infrastructure needed to develop and roll out transformative technologies.

One takeaway from Glasgow has been that securing green finance at scale will be essential for the GRID agenda. However, developed countries found it difficult to secure the necessary funding for developing countries to implement the green transition to sustainable and equitable development.

But there may be a silver lining. The global economy is awash with excess savings estimated at around $3.9 trillion that are earning negative or low returns and there are $46 trillion of pension funds in search of reasonable returns. The low carbon transition may offer an opportunity for investors, especially as the returns to green investments begin to exceed investments in more conventional technological choices.

Necessity and urgency of systemic investments and transformations

Transformational actions will be needed in key systems — for example, energy, agriculture, food, water, land, cities, transport and manufacturing — that drive the economy and account for over 90 percent of greenhouse gas emissions. Without significant change in these sectors, neither climate change mitigation nor sustained and resilient development are possible. Such a transition, by addressing economic distortions, will promote greater economic efficiency and reduce adverse productivity and health impacts, leading to better development outcomes.

Domestic resource mobilisation can also be increased by enhancing tax progressivity, applying wealth taxation, and eliminating tax avoidance. There is also a need for greater selectivity and efficiency in spending.

But the fruits of the transition may not be evenly distributed and will require a range of social and labour market policies that address adverse impacts, safeguard the vulnerable and deliver a just transition. The GRID approach, therefore, supports a transition to a low carbon economy while considering countries’ energy needs and providing targeted support for the poorest.

Significant reforms of fiscal systems will be needed to mobilise domestic resources and finance the transition. Taxes on externalities are a large and unused source of potential revenue, which can create incentives for the private sector to invest in more sustainable activities. Domestic resource mobilisation can also be increased by enhancing tax progressivity, applying wealth taxation, and eliminating tax avoidance. There is also a need for greater selectivity and efficiency in spending.

A strong private sector involvement will be needed. The scale of investment needed far exceeds the possibilities of the public sector. Reforms are needed to remove constraints to private investment in appropriate sectors and technologies. Thus, at the country level, a strong partnership and dialogue between the public and private sector is urgently needed. And further developing and implementing green financial sector regulation, such as reporting standards and green taxonomies, can help harness investors’ increasing appetite for sustainable investments, which offer both measurable impacts on the environment and society.

However, sustainable and substantial flows of finance across borders will need to supplement domestic efforts. Multilateral development banks (MDBs) and Development Finance Institutions (DFIs) must focus on catalytic and transformational investments in priority areas to develop green, inclusive and resilient project pipelines that support economic growth, and job and income generation. On this front, MDBs can help lower risks for private capital through guarantees and blended finance. But at the end of the day the most effective way to attract private capital is through policies that correct distortions that render environmental destruction profitable.

Multilateral development banks (MDBs) and Development Finance Institutions (DFIs) must focus on catalytic and transformational investments in priority areas to develop green, inclusive and resilient project pipelines that support economic growth, and job and income generation.

Climate change is a reality shaping lives as we speak and not a distant mirage that will materialise only in the future. From Pacific Island nations facing rising sea levels to the Sahel region struggling with longer dry seasons, climate change is changing lives of the poor and vulnerable across the world. The future for the world’s climate vulnerable groups will remain bleak unless we transform policy and economic thinking and secure the financing that is needed.

Countries face a historic opportunity to establish a better way forward. Despite the damage wrought by the pandemic, the exceptional crisis response offers a unique opportunity for a “reset” that addresses past policy deficiencies and chronic investment gaps. Crisis related expenditures can be used to invest in new opportunities, such as accelerating digital development, an expansion of basic service provision, improvements in regional supply chains, strengthening ecosystems services, and policies to catalyze job creation in growth sectors. Private sector dynamism and innovative financing will need to power the recovery and to create economic growth and employment through investment and innovation. Public-private partnerships and key upstream policy reforms can spur private investment (including FDI), support viable firms through restructuring, and enable the financial system to support a robust recovery through the resolution of non performing loans.

Undermining institutions, underwriting OBOR: Beijing and the crisis of global governance

This article was co-authored with Mihir Swarup Sharma.

This article is part of the series The Beijing Heist: Making Global Institutions Serve the CPC Agenda

All good things must come to an end, and so must illusions of the promised common future. A fundamental assumption long held by many in the West is that the multilateral institutions instated over the six post-War decades would serve to constrain and direct the “peaceful rise” of the People’s Republic of China (PRC). It was believed that a Beijing that was given the position it thought justified within the multilateral architecture would end up being a responsible steward of these institutions and of the global commons more broadly. The scandal at the World Bank that led to the end of the Doing Business report and index is the third time that this assumption has been proved as naïve, and, indeed, delusional.

The World Bank scandal is directly linked to the Xi Jinping regime’s growing sense of entitlement. An independent report commissioned by the Bank has revealed that its leadership— including a former senior official, Kristalina Georgieva, who is now head of the International Monetary Fund (IMF)—apparently manipulated the supposedly independent report to placate PRC officials worried about their ranking. The immediate context? Ownership shares at the Bank were going to be “re-calculated”; in other words, the PRC was going to see a big boost in its control of the institution. (Eventually, 52 countries had to reduce their voting share in the Bank to increase China’s.) It was the anticipation of Beijing’s increased power over the institution that led to this episode; it appears a careerist international bureaucracy was all too eager to please the new ownership. Many will now want to more closely examine Beijing’s position on the acrimonious selection in 2019 of a new IMF Chief from within the European bloc.

The World Bank scandal is directly linked to the Xi Jinping regime’s growing sense of entitlement. An independent report commissioned by the Bank has revealed that its leadership apparently manipulated the supposedly independent report to placate PRC officials worried about their ranking

Two other institutional pillars of global governance have already been left powerless and have faced global ridicule as a consequence of Beijing’s actions. The World Trade Organisation (WTO) has lost the trust of the world in the two decades since the PRC’s accession; many of its members, developed and developing alike, feel that the PRC has not conducted the reforms that it had promised in order to join. As a result, it has retained an advantage in global trade that the WTO has been unable to rectify, leading to the institution itself being considered worthless. And then there is the World Health Organisation (WHO), which has been seen during this pandemic as prioritising Beijing’s sensitivities over warning the world about a deadly contagion—or even properly investigating its origins. The tight control of information by the Communist Party of China (CPC) means that questions remain unanswered about the virus’ origin, yet what is certain is that the pandemic’s initial spread is in no small part due to the CPC’s machinations and missteps, and the WHO leadership’s complicity with Beijing.

It is time to accept that ceding Beijing the control of the levers of global power leads to disastrous consequences. Liberal democracies such as India and those that designed the post-War multilateral structure understand the need for independent institutions. They may chafe at the pressure such independence brings to bear on their own domestic and geopolitical actions, but appreciation of the importance of institutional strength and independence is in their DNA. This is, of course, not true for the Communist Party of China. Why should anyone expect that a system that permits no independence domestically will not consider it necessary to seize control of global institutions as well? For them, those institutions are useful that perpetuate and further the party line.

Liberal democracies such as India and those that designed the post-War multilateral structure understand the need for independent institutions.

The Ease of Doing Business report and it’s deserved demise should not worry us. Concern about what will follow next should be more widespread. That Georgieva’s name has appeared in this investigation is worrying given that the IMF, in particular, is under siege. Its previous head, Christine Lagarde, explicitly made the point that Beijing’s “One Belt, One Road” initiative risked leading to a debt explosion in the developing world that would become the IMF’s problem. Under Georgieva, the pandemic did, in fact, cause an emerging-economy debt crisis in 2020. Other state-run lenders wanted to grant some measure of relief to those countries most under pressure. The PRC’s financial institutions refused to play along, demanding that they be treated like private-sector bond-holders instead. Georgieva seemed to excuse this behaviour, saying in October 2020, “What we are also hearing from China is a recognition that they are a relatively new creditor, but they are very large creditor, and they need to mature domestically in terms of how they handle their own lenders, the coordination among them.” The problem with the PRC’s external lending is not a lack of maturity or of co-ordination. If anything, the problem is the opposite: Too much co-ordination and political control. Will future bailouts spend IMF money to save Beijing’s bad Belt-and-Road loans? In a closed-door meeting in New Delhi some summers back, an American diplomat who had just finished meeting his counterparts in Colombo explained to Indian analysts that its Chinese debt that has ravaged Sri Lanka’s balance sheet and that a IMF bailout was inevitable—as, indeed, it turned out to be.

Unless all of us recognise the danger Beijing poses to global institutions, we will wind up paying for the expansion of Chinese ownership and political control over vast geographies.

An IMF that fears Beijing’s wrath is one that will not protect its shareholders or global private capital. Lending related to the Belt and Road initiative will cause more and more crises going forward, perhaps sooner rather than later, given the effect the pandemic has had on emerging economies’ balance sheets. An IMF intimidated by one activist minority shareholder might well direct the world’s savings into bailing out the PRC’s lending.

Unless all of us recognise the danger Beijing poses to global institutions, we will wind up paying for the expansion of Chinese ownership and political control over vast geographies. This is the global equivalent of the privatisation of profits and socialisation of loss—badly designed projects will create profits, power and growth for the benefit of the CPC, and their adverse economic outcomes will be left to the world to underwrite. The US has mishandled the World Bank already; does the European Union have it in them to save the IMF?

Global trade after COVID-19: From fixed capital to human capital

Co-authored with Dr. Alexis Crow

Some commentators have trumpeted the “end” of globalization in the wake of rising protectionism over the last half decade, the sudden economic stops wrought by COVID-19, and the corollary disruptions of supply chain activity around the world.

The truth, though, is that for companies and investors involved in the exchange, transmission, and sale of goods, services, technology and finance, globalization is anything but dead. Granted, the landscape has dramatically shifted since the 1990s, and executives will need to be nimble and agile in navigating the new environment, which is currently in a state of flux.

Indeed, more recent developments in the global trade environment including green frameworks, digital protocols and regional partnerships offer a glimpse not of the demise of globalization, but rather, of what global trade may look like in the post-COVID-19 era.

Globalization and its “discontents”

Globalization is defined as the process by which technology and the information and communication technology (ICT) revolution of the 1990s enabled faster transaction times and processes for exchanges of currency, capital, information, innovation, goods and people around the world.

These transmissions of commerce have been facilitated by norms, laws, regimes and treaties governing trade, such as the World Trade Organization at the global level and agreements such as ASEAN at the regional level. At a national level, the creation of free-trade zones further facilitated the ease of trade: for example, a shipping container can move through a seamless logistics corridor in the United Arab Emirates from the Port of Jebel Ali to the Dubai International Airport within four hours.

In financial services, hubs such as the City of London and latterly Singapore have attracted leading talent from across the globe to investment banking, trading, fintech and asset and wealth management, with executives and their teams using these hubs to penetrate the “spokes” of business in the EMEA (Europe, Middle East, Africa) and south/southeast Asian regions.

Unfortunately, the very same global interconnectedness that facilitated wealth creation and economic opportunities also had a dark side that manifested throughout the 1990s and 2000s. Global and transnational risks such as international terrorism (such as the attacks of 9/11), environmental degradation, cyber-attacks, pandemics, human trafficking and financial instability and financial crises ricocheted across the globe. Such risks might pop up in one jurisdiction and by the very same conduits that fostered the “bright side” of globalization easily spread across geographies.

Today, we might say we are dealing with a different shade of discontent within societies— particularly pronounced within advanced economies—for which the process of globalization is often blamed: rising domestic income inequality. While global trade has lifted billions of people out of poverty and sharply reduced inequality at a global level (such as that between China and the West, and southeast Asia and the West), income, wealth and opportunity inequality have been steadily rising within countries such as the United States, the United Kingdom and Italy. Clearly, the benefits of globalization have not been shared by all. Yet, the globalization of labour markets is but one of a number of contributing factor to rising inequality within these societies since the 1980s.

Nevertheless, some leaders have found it both palatable as well as politically convenient to point the finger of blame at other countries. Rising income generation and economic advancement in Japan, for example, became a target of ire within certain circles in the United States during the late 1980s and early 1990s. More recently, some activist politicians and commentators have pointed to the economic gains made by certain groups (such as immigrant workers) as a clear causal factor for the erosion of the domestic middle class.

Rising economic nativism has taken various forms within the last few years and has in some cases been accelerated in the wake of the COVID-19 pandemic. Regardless of the underlying causes of domestic inequality and social anxiety, politicians have acted out against trade in the following ways:

- Ructions against goods. In recent years, some countries have focused on the balance of trade in goods (or the imbalance) as a way to reduce imports or to onshore production. Tariffs became the policy tool of choice as a way of addressing such imbalances, but when implemented, have had mixed results. Data shows that efforts to boost domestic production of goods and services comes at a cost: quite literally, for the governments, companies and consumers.

- Restrictions on mobility. Responses to the angst felt against global trade have not been limited to goods or volume of merchandise. States have also moved to restrict immigration, vowing to protect domestic workers from a perceived disadvantage. It is important to note that curtailing mobility also comes at a cost—during COVID-19 restrictions, a sharp reduction in migrant agricultural workers within OECD countries has contributed to a sharp rise in food prices, which have reached a six year high.

- Tech bifurcation. Although countries, companies and individuals are importing and exporting more services than ever before, a bifurcation has developed between the United States and China regarding certain aspects of trade in technology. Indeed, the situation has been referred to this as a “technological Cold War” between the “two greatest powers” in the world.

While some European countries have also passed legislation to restrict inbound investment in specific targets or sectors, the EU-China Comprehensive Agreement on Investment (CAI)—signed at the end of 2020—was designed to improve laws and practices for mutual investment between China and the EU, at a federal level. Although currently on hold, the negotiations did demonstrate a willingness for both sides to convene in order to potentially step up the level of investments within their respective economies.

Three emerging paths forward

Within a turbulent geopolitical context, the shape of a post-COVID-19 trade landscape is becoming clearer, particularly regarding the digital, green and regional spaces.

- The digital realm

A multilateral framework is… the need of the hour to avoid any more trade wars that the pandemic-stricken world economy cannot bear.

Data protection and securing user privacy in the digitized world has been a major issue of cross-border friction. But here we are seeing concrete efforts being made. To this end, the EU General Data Protection has offered a common template that has even inspired the California Consumer Privacy Act.

This is not to say that all contentious issues have been resolved. One complicated issue has been the taxation of digital services. Although there has been an attempt by the OECD to devise a framework for digital taxation, a multilateral solution has not evolved so far. Against this backdrop, the United Kingdom, France, India and Italy among other countries have started levying taxation on digital services, with the United States taking subsequent action under Section 301 of its trade law. A multilateral framework is, therefore, the need of the hour to avoid any more trade wars that the pandemic-stricken world economy cannot bear.

The fact that there is some early convergence on contentious issues is a positive dynamic and suggests that even though an overarching framework governing the digital realm is elusive so far, consumer interest will be the guiding force in determining the nature of regulation.

- The green space

Increasingly, at least in the developed world, “going green” is the new industrial and growth strategy.

Climate action is the base on which economic policies of the twenty-first century are likely to be formulated—increasingly, at least in the developed world, “going green” is the new industrial and growth strategy.

To be sure, there are challenges. Recent discussions on the EU’s carbon border adjustment mechanism, essentially an emissions-related import tariff, are the first sign of movement towards a global “carbon club”, shutting out exports from countries that may not comply. But the current moment presents a historical opportunity for cooperation. As climate commitments strengthen across the globe, economies of scale have led to rapidly falling costs for green energy and technology.

- A region-based approach

As efforts are underway at reforming the global trading system, regional or bilateral agreements are helpful in providing building blocks for greater cohesion.

While many Western countries have been contending with populist movements in the years leading up to COVID-19, and then resurgent strokes of economic nativism in the wake the pandemic, countries in Asia signed the largest trade agreement in history—the Regional Comprehensive Economic Partnership (RCEP) in November 2020.

Effectively, RCEP incorporates some rich income Asian countries within the ASEAN community; and in a historic step, it is the first framework to include China, Japan and South Korea together within a trade agreement. While some commentators argue that RCEP is less comprehensive than other deals such as the Trans-Pacific Partnership agreement, the convening of RCEP signatories signals Asia’s continued commitment to connect “multiple factory floors” at a regional as well as a global level.

The cementing of RCEP—with the participation of some of the fastest growing economies in the world—raises the question: do regional trade agreements help or hinder the global trading landscape? With variegated standards on data privacy, green and carbon, and with countries at various stages of economic growth and employment, a global architecture might be elusive. It can therefore be argued that as efforts are underway at reforming the global trading system, regional or bilateral agreements are helpful in providing building blocks for greater cohesion.

Reaping the benefits of a global division of labour and capital

Even though the global trading architecture has taken severe knocks from both populism and the pandemic, nearly one-third of the world’s population and one-third of global GDP have recently been incorporated in a historic trade agreement.

And even amidst the “great lockdown” of 2020, the contraction of global trade in goods was less than half of that of the trough of 2009, in the wake of the global financial crisis. Moreover, an asynchronous regional recovery from COVID-19 has meant that many companies have been able to make up for the loss demand in one region (such as Europe) by the growth in demand in another region (such as China). And uneven sectoral activity, such as the working-from-home dynamic, is propelling demand for critical goods such as semiconductor chips, which is propping up export markets for countries such as South Korea. The growth of the electric vehicle industry and the commitments by governments to “build back greener” are also contributing to cross-border flows of metals and materials.

Nevertheless, as policy-makers set their priorities on rebuilding their societies, the lure—or mystique—of self-sufficiency remains strong. Indeed, the COVID-19 pandemic has caused severe losses to income for both advanced as well as emerging economies—the former experiencing a loss of 11% of income of 2019 levels, and the latter nearly double, at 20%. Yet, the way out of economic desolation is not via isolation, or constructing a fortress nation.

The way out of economic desolation is not via isolation, or constructing a fortress nation.

The way out of economic desolation is not via isolation, or constructing a fortress nation.

Laudably, within some advanced economies, COVID-19 relief measures have catalyzed the implementation of policies, including those designed to address housing affordability and access to childcare, that are meant to combat systemic income inequality. As countries transition from relief to recovery, and policy-makers weigh up prospects for bolstering domestic employment, it goes without saying that demand for many jobs within tradeable services is implicitly connected with the viability of export markets.

Thus, the ability to underpin and renew export ties with dialogue—such as that recently conducted between the US and the EU—is integral to sustainable domestic growth. Additionally, in the realm of non-tradable services, creative policies to incentivize corporate and private investment in reskilling, upskilling and learning for working are absolutely critical – in essence, segueing from investing in fixed capital to human capital. Amplifying competitiveness and improving productivity in both tradable and non-tradable sectors can also be enhanced by infrastructure spending and investment, in hard and soft sectors.

In the realm of non-tradable services, creative policies to incentivize corporate and private investment in reskilling, upskilling and learning for working are absolutely critical – in essence, segueing from investing in fixed capital to human capital.

In the realm of non-tradable services, creative policies to incentivize corporate and private investment in reskilling, upskilling and learning for working are absolutely critical – in essence, segueing from investing in fixed capital to human capital.

As countries increase investment in non-defense related R&D in sectors such as biotech and electric transport, it is important to consider that innovation is implicitly tied to immigration. In the United States, this has been the case throughout the 19th and 20th centuries, and with immigration as one causal factor of the blossoming of cutting-edge technology businesses and the growth of entrepreneurship in the country. Thus, data shows that the vitality of human capital is inherently cross-border and reliant on immigration. Recognizing this is a requisite component of any industrial, or rather, post-industrial policy, for advanced economies and for emerging and developing economies that are shifting from old to new economic growth.

Originally published https://www.weforum.org/agenda/2021/05/the-global-trade-map-after-covid-19-from-fixed-capital-to-human-capital/

In a new world, why old Europe matters

While Covid-19 has disrupted societies, it has also brought greater clarity for individuals and nations. The European Union (EU) and the United Kingdom (UK) are two political geographies that may be experiencing this and are certainly at an inflection point. In this context, foreign secretary Harsh Vardhan Shringla’s visit to Paris, Berlin and London gains salience. That he has chosen Europe for his first Covid-19-era visit outside the neighbourhood suggests that New Delhi has sensed the importance of this moment.

At a recent event, external affairs minister, S Jaishankar, articulated why his ministry continued to invest time and energy in the relationship with Europe. He explained Europe’s importance for India’s most important imperatives — be it technology and the digital domain or becoming a green economy. The region holds the promise of long-term capital, innovation, markets and best practices.

Europe’s economic obsession following the 2008 Global Financial Crisis saw it withdraw from key political theatres. The pandemic has brought it right back to the great churning in Asia and indeed to the Indo-Pacific. The Indo-Pacific Strategies released by Germany and France and the India Strategy announced by EU are indications that the Old Continent is changing course. The UK has hinted that it is realigning its political positions. It is currently engaged in its most comprehensive integrated review of security, defence, development and foreign policies since the Cold War.

Much has been written about the divisions within EU. Economic differences, migration policies and the China factor all have a real basis and have impacted EU. These may well remain points of friction among member-states. The UK’s exit has also had consequences. Paradoxically, the events of 2020 have exposed the limits of fissiparous tendencies in EU.

There is now a disturbing realisation that China is no friend, and it is not like Europe. It drives the same vehicles and uses the same phones, but is not driven by the same values and principles. There is no convergence in world views. The perverse, even vulgar, conduct of mask diplomacy and thereafter the Wolf Warrior doctrine has been deeply disturbing to European sensibilities. Chinese foreign minister Wang Yi’s troublesome EU sojourn indicated a new European resolve to call out China, even as Beijing dug its heels in.

There is now a disturbing realisation that China is no friend, and it is not like Europe. It drives the same vehicles and uses the same phones, but is not driven by the same values and principles. There is no convergence in world views

In the UK, too, the boundaries of Brexitism are being tested. On 5G and technology choices, the UK and major EU countries are aligning positions. Global Britain is navigating new seas, but its ethical and strategic compass is keeping it firmly in the Atlantic Order. The earlier assumption at 10 Downing Street that it was possible to do business with China without being affected by its muscular politics has fallen short. The bears and bulls at the London Stock Exchange have danced for the Dragon far too long. In 2021, as it hosts G-7 — with India as a likely guest — and COP-26, the UK will realise exactly how much it remains embedded in Europe.

Shringla will find in his French, German and British interlocutors a new realism on trade. Free trade deals are not the issue they once were. The World Trade Organization (WTO) has reduced tariff barriers and the pandemic has enhanced the appreciation for non-tariff barriers. Boutique trade deals, supply chains restructuring where feasible, and enhanced linkages in health and vaccine value chains will be the focus. There will be less pressure on, and more opportunities for, India.

Shringla will find in his French, German and British interlocutors a new realism on trade. Free trade deals are not the issue they once were. The World Trade Organization (WTO) has reduced tariff barriers and the pandemic has enhanced the appreciation for non-tariff barriers

Realising the Sustainable Development Goals; battling the climate crisis through green transitions; and building a digital economy must also be on the menu. Post-Covid-19, we must build back green and build back better. In the past four years, the Paris Agreement has rested on European and Indian shoulders. It is time for Europe and India to shape a new global green deal. This EU+1 initiative should be on Shringla’s agenda as he engages with Paris and Berlin.

In London, he must create the ground for a bold UK-India announcement at COP-26 with an emphasis on a financing a framework that can catalyse green growth. India co-founded the International Solar Alliance with France and the Coalition for Disaster Resilient Infrastructure with the UK. These are critical legacies to be nurtured, more so since the United States (US) will continue to go through an existential crisis, to some degree, irrespective of what happens in early-November.

Technology is another shared frontier. Even as Europe invested in Chinese manufacturing zones, data from its banks, insurance and financial firms found safe and efficient homes in India. Trust was the operative word. And this same word will define partnerships in the Fourth Industrial Revolution. Digital partnerships between India and EU and concurrently India and the UK are inevitable and desirable. As they assess the extremes of the American and Chinese models, on technology norms, digital regulations and data privacy, India and various shades of Europeans will find their positions more aligned.

Technology is another shared frontier. Even as Europe invested in Chinese manufacturing zones, data from its banks, insurance and financial firms found safe and efficient homes in India. Trust was the operative word

With the US expected to be preoccupied till the new administration settles in by early-summer 2021, New Delhi is doing well to engage with other major Western democracies that, like India, are contributors to stability in the international system. Coming shortly after Jaishankar’s visit to Japan for the Quad talks and bilateral meetings, the foreign secretary’s trip to the heart of Old Europe is an important follow-up.

By the global ball and value chain

While MNCs are choosing well-established regional supply chain in East and Southeast Asia for now, India must look to the futu

Of the many ways the post-Covid world will look different, the rapid confluence of trade, technology and national security will rank high among them. The US’s assertion in the 2017 National Security Strategy (NSS) that ‘economic security is national security,’ EU Commission President Ursula von der Leyen’s call this February for ‘tech sovereignty’, and China’s focus on ‘self-reliance’ in strategic technologies portend a new age for geo-economics. All three areas have acquired a sharper edge in the middle of the pandemic.

India must signal to its citizens, businesses and the international community how it plans to respond to this moment being shaped by three developments. First, the weaponisation of economics and trade, a trend prevalent among partners and rivals alike. Second, the measurement of national power will now be based on the ability to control global digital flows comprising technology, information, human capital and finance. Can India be an influential actor?

The decoupling of supply chains due to the sharpening US-China trade war makes this an imperative. GoI seems to have sensed this moment and is attempting to seize it.

And third, old industrial tools like import substitution and market restrictions will need radical repurposing for these times. Can India devise a new mantra compatible with the latest version of globalisation? All of this translates into one layered question: How can India first attract large investments, then grow and develop its technology sector, and finally share and export ‘Digital India’ to other geographies?

This will be based on India’s ability to manufacture for, and service, the growing digital markets, as well as shape the norms, rules, standards and topography of global physical and digital supply chains. The decoupling of supply chains due to the sharpening US-China trade war makes this an imperative. GoI seems to have sensed this moment and is attempting to seize it.

Dislocations in trade and technology are an opportunity to attract global investors. India has done poorly in the past. A September 2019 Nomura report suggested that of the 56 companies relocating out of China, only three have opted for India. Nevertheless, decoupling is a long-term process. While MNCs are choosing well-established regional supply chain in East and Southeast Asia for now, India must look to the future.

Beijing’s economic statecraft underpins its efforts to shape the world in its own image through territorial aggression, debt-trap diplomacy and institutional capture.

In this regard, India’s decision to announce three interrelated schemes on production-linked incentive (PLI) for manufacturing of components and semiconductors, and electronics manufacturing clusters, is important. These replace the earlier ‘merchant export from India’ scheme, and align India’s support for its nascent electronics industry with WTO rules. This new regime for manufacturing and export is designed specifically to draw in large global manufacturers like Apple and Samsung, facilitating the relocation of a part of their production base and downstream suppliers to India.

The ability of just a few global investors to help India integrate into global supply chains (GSCs) should not be underestimated. For example, the market value of the hardware Apple produces in China was nearly $220 billion in FY2019, of which it exported $185 billion, dwarfing India’s total electronics exports of $8.8 billion in the same year. Apple has over 800 production facilities globally, over 300 of which are based in China. Even minor relocations of these value chains to India will be beneficial. The reported relocation of certain processes to India by Apple contractors Wistron and Foxconn, among the largest and most sophisticated Taiwanese electronics manufacturers, will bring with them their own secondary supply chains.

Such opportunities will multiply for India — such as the Britain-proposed ‘D10 alliance’ (a club of 10 democracies) on 5G and emerging technologies — begin to reorganise patterns of trade to favour nations ‘politically trustworthy’. The logic driving disengagement with China on crucial supply chains is obvious. Beijing’s economic statecraft underpins its efforts to shape the world in its own image through territorial aggression, debt-trap diplomacy and institutional capture. Part of India’s response to this reality will be political muscularity along the border and in the oceans. The other, more durable, response will be an obsessive nurturing and growth of the economy.

These ventures are also a litmus test for GoI’s resolve for reform.

This must be dictated by a strategy that enhances India’s ability to integrate into the production and manufacturing of strategic technologies, to secure value from global data flows, and to grow Indian platforms and digital propositions for the world. Growing and new investments from US blue-chip tech giants like Apple and Facebook into India’s manufacturing base and digital platforms augur well.

But these ventures are also a litmus test for GoI’s resolve for reform. In 1982, GoI’s integration of Suzuki into the domestic market for automobiles spawned a new wave of investments into this sector making it one of the world’s most competitive. As the realignment of supply chains accelerates post-Covid-19, investors from around the world will be closely watching the performance of these major global corporations in India before making their own decision.

ORF takes on the budget

The allocation for health of around INR 63,540 crore is about a 13% increase from last year. Much of it has been to PMJAY, the flagship scheme of the government, which saw allocation rise from INR 2,400 crore last year to INR 6,400 crore in the interim budget. Ayushman Bharat’s second arm, the HWCs also got considerable hike in budget allocation — from INR 1,200 crore to INR 1,600 crore. FSSAI as well as the National AIDS Programme have also seen improvements in allocation.

However, an exclusive focus on PMJAY can result in a possible de-prioritisation of core health system functions, with slow-down or reduction of allocations under various heads, including NHM. Capital outlay on medical and public health, for example, has come down from 3047.67 crore in 2017-18 (actual) to 2391.33 crore in 2018-19 (RE) to 1675.90 crore in 2019-20. This can potentially impact health system’s capacity to expand in areas that need health services the most. Neglected areas can remain neglected unless there is specific focus. The budget document stated that of the 3,508 HWCs already operational, only 582 are in the aspirational districts, or the districts lagging in health development.

An exclusive focus on PMJAY can result in a possible de-prioritisation of core health system functions, with slow-down or reduction of allocations under various heads, including National Health Mission.

Lastly, it is easy to celebrate the INR 6,400 crore allocation, meant for around 50 crore PMJAY members. Still, the money allocated remains around INR 1,000 crore short of a conservative estimate of PMJAY spending this year. To put things in perspective, healthcare coverage to just around 35 lakh CGHS beneficiaries will cost the exchequer INR 3,000 crore, of which INR 2,850 crore was allocated in the interim budget. In addition, delays in payment of sanctioned amounts undermining efficiency of PMJAY remains a real risk, as with many health schemes. As of now, reports indicate that of the INR 2,400 crore allocated last year for PMJAY by the MoF, INR 1,000 crore has yet not been released, and that there are outstanding payments from the Centre to the States amounting to INR 1,700 crore under PMJAY. This can potentially impact the sustainability and effectiveness of the scheme.

It was decided by the government that India’s government health spending will be 2.5% of its GDP by 2025. At the current pace, it will be impossible. As a percentage share of total budget, the interim budget outlay on health was just 2.2%, below the figure in 2017-18, where the proportion of health outlay peaked under the Modi regime at 2.4%. Health in India needs significant additional resources, and not reallocation of existing resources. Ayushman Bharat becoming the flagship health initiative cannot and should not lead to a case of the government missing the forest for the trees. Without expansion of real health infrastructure, Ayushman Bharat will be just band-aid.

AI and automation technologies

The Union Budget 2019 signals early forays into artificial intelligence by the Indian government with the announcement that a National Centre on AI will soon be set up. This centre will presumably work in close coordination with Centres of Research Excellence in Artificial Intelligence (COREs) that were first proposed by the NITI Aayog in its discussion paper: National Strategy for Artificial Intelligence. While the NITI Aayog identified five areas primed for AI intervention, namely healthcare, agriculture, education, smart cities and smart mobility, the Union Budget speech hints that four more priority areas have been identified.

In a manner now idiosyncratic of the Modi government, the Minister of Finance also announced plans for the creation of an ‘national AI portal.’ Details of what this portal will achieve or what it will be meant for remain unclear. Also missing from the budget are critical details around the quantum of investment in AI and automation technologies that are being planned.

Conspicuously missing from the budget are any references to digital payments or cyber security — both strong protagonists in Modi’s Digital India.

The Finance Minister’s speech also revealed ambitious plans to digitise one lakh villages over the next five years as a part of the Digital India programme by providing WiFi access to these villages. This initiative will be spearheaded by the Common Service Centres that now serve as nodal points of delivery for public utility services.

Conspicuously missing from the budget though are any references to digital payments or cyber security — both strong protagonists in Modi’s Digital India. This absence will likely be felt by Indian tech companies who for a few years now have been demanding economic relief for domestic players to level the playing field and compete with the seemingly limitless cash inflow that US and Chinese tech startups seem to be riding on.

Indian defence

While the defence budget has been pegged at INR 3.05 lakh crore, an increase in absolute terms, the percentage of the GDP used for India’s defence for the year 2019-2020 remains at the measly 1.5% mark, still very low for any effective modernisation to take place. The interim finance minister, in his budget speech, has stated that the current defence personnel will see a rise in the Military Service Pay (MSP), while at the same time allocating funds for special allowances of Air Force and naval personnel who are stationed in high-risk zones. Apart from this funding of the military, the government has also earmarked a separate INR 35,000 crore as part of its OROP pension payments, in line with the BJP election manifesto. However, this defence budget still does not take into account the modernisation needs of the country, pegging only INR 1.08 lakh crore for new weapon systems, while the day-to-day expenses have been given a budget of INR 2.10 lakh crore.

This budget, while being touted as the largest increase in the defence budget of India, still reveals the fact that the Indian military is not being given enough room to upgrade its current equipment to keep pace with the rapid modernisation of the Chinese military. The budget highlights the fact that the government is only willing to keep its military functioning at the level it already is, not taking into account the asymmetry between itself and its neighbours in terms of both technology and equipment possessed. While there is no doubt that this year’s budget is a step forward in the right direction with more money being pooled in the upkeep of the military, serious attention needs to be paid to the slow speeds of modernisation of the military’s resources, which will prove to be a major factor in the coming years, in a time where the Chinese have begun downsizing and modernising and indigenising their equipment to meet the new threats of both the present and the future.

This budget, while being touted as the largest increase in the defence budget of India, still reveals the fact that the Indian military is not being given enough room to upgrade its current equipment to keep pace with the rapid modernisation of the Chinese military.

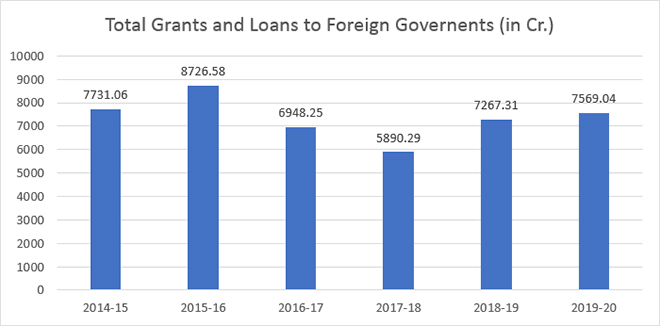

Towards economic diplomacy

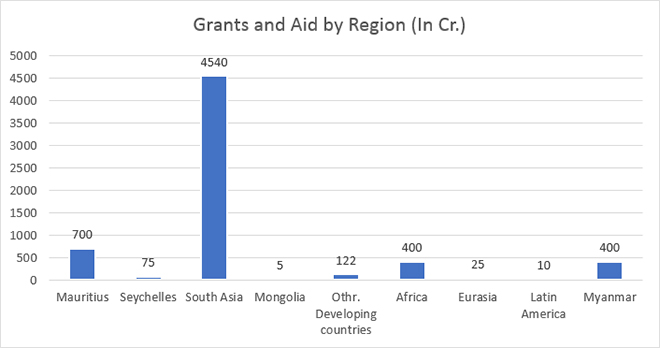

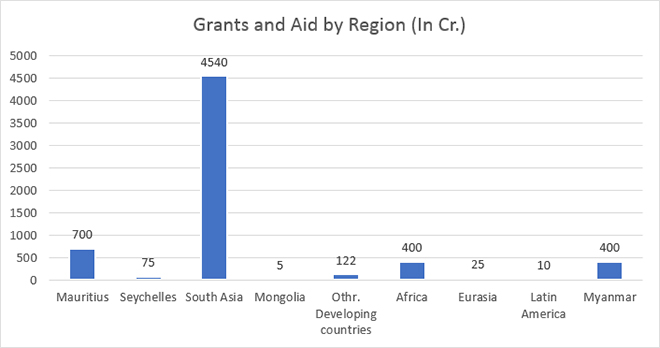

Compared to an allocation of INR 12,620 crore in 2014-15, the overall grant to the MEA in 2018-19 is INR 16,061 crore.

India’s allocation towards economic diplomacy has steadily crossed the USD 1 billion mark.With India already contributing nearly 15% to global growth, it must interrogate the consequences of its development partnerships more closely as allocations rise over the next decade.

Two notable heads this year are aid to the Maldives and the Chabahar port. Following the establishment of a friendlier government in Male, India has more than quintupled its aid to Maldives — from INR 109 crore in 2018-19 in the original estimate, to INR 440 crore in the revised 2018-19 estimate, and to INR 575 crore this year. And continuing a new practice from last year, India has allocated INR 150 crore for the development of the Chabahar port.

These investments reveal India’s crucial connections to both the Indo-Pacific and the Eurasian landmass. However, while South Asian states receive the bulk of India’s economic assistance, India’s aid to Eurasia stands at INR 25 crore this year.

India’s investments in regional institutions also remains unfortunately low: INR 8 crore each for the SAARC and BIMSTEC Secretariat. While the BIMSTEC budget has doubled over the past two years, it remains insufficient to create effective human or technical capacity in the institution.

Over all, the 2019-20 Budget makes clear that India must recalibrate its approach to economic diplomacy in the region, especially given its domestic constraints.

For one thing, India must begin to identify priority sectors and States — especially in the Indo-Pacific and Eurasia. Development projects that create social and economic value for local communities and where India has a comparative advantage will be key. Supporting institutions like BIMSTEC and the IORA will also be important.

Second, convincing India’s private sector to invest in the infrastructure needs of developing countries will also be crucial. Indian Overseas Direct Investment in developing countries is still limited. Budgetary support by way of concessional financing for Indian companies investing in strategic infrastructure projects abroad also remains low.

Third, India’s concessional LoC framework must be made more competitive and transparent. Many privately admit that loans are arbitrarily granted to a select few Indian actors. There is also little available data on the economic benefits that accrues to India.

Fourth, plugging India’s capital gap will require imaginative collaboration with international donors. India must explore multilateral cooperation mechanisms with the US, the EU, Japan and Australia have all announced new economic initiatives in the Indo-Pacific and Eurasia.

Given that India will emerge as one of the largest sources of development finance in the coming years, it is time for the Government to release a white paper on how development partnerships can advance India’s economic and strategic interests.

Education: Less money to State institutes and technical colleges

The Interim Budget 2019 allocated INR 93,847.64 crore to education, which is although the largest till date with about a 10% increase from last year’s budget allocation — it is still only about 3.3% of the GDP. While the increase in allocation is a good sign, it has again failed to target the recommended 6% of the GDP required for India to inch closer to the Agenda 2030 of Sustainable Development Goals of the UN. Unlike last year, this year’s budget speech gave little importance to education as a priority sector for the economic development of the country.

Of the total budgetary allocation, school education yet again received the highest revenue of INR 56,386.63 crore, up from 50,000 crore in 2018-19. The National Education Mission (which comprises the Samagra Siksha Abhiyan for school education from pre-primary to class 12 and teacher training programmes) saw the maximum outlay of INR 36,472 crore, up from INR 31,212 crore in 2018-19. Although this is an increase, it is not enough to address the issues in school education, which has a massive near-perfect enrollment rate. Allocation to mid-day meal scheme that is known to increase attendance and improve health among children has seen paltry increase of INR 500 crore from last year. Most disheartening is to see a reduced outlay of about INR 87 crore for central schemes such as National Scheme for Incentive to Girl Child for Secondary Education, National Means cum Merit Scholarship Scheme, National Award to Teachers and Digital India e-learning.

While the increase in allocation is a good sign, it has again failed to target the recommended 6% of the GDP required for India to inch closer to the Agenda 2030 of Sustainable Development Goals of the UN. Unlike last year, this year’s budget speech gave little importance to education as a priority sector for the economic development of the country.

As for higher education, it has yet again failed to garner the attention of the policymakers. This year’s interim budget allocated INR 37,461 crore, which is a small increase of about INR 2,000 crore for 903 universities, 39,050 colleges and 10,011 standalone institutions in the country. Fund allocations to statutory bodies like UGC, AICTE, have decreased, which means lesser money to state institutes and technical colleges. Rashtriya Uchchatar Shiksha Abhiyan (RUSA), which funds all the State universities and colleges has seen an allocation of INR 2,100 crore, which is about INR 700 crore more from last year. This is highly insufficient for the upgrade of educational institutes in the States that are in a pitiable condition. To fund major infrastructural projects through loan grants, last year Higher Education Financing Agency (HEFA) was allocated INR 2,750 crore, however that too has been reduced to INR 2,100 crore this year. HEFA also funds capital expenditure of the elite institutes that have been asked to allow 10% EWS quota and increase their intake capacity by 25%. These will need major revenue boost, that seems impossible from the current budget outlay. Fund allocation to central universities too have been reduced. The only major improvement in higher education seems to be the increase in salary scale for professors and funds allocated to research and innovation activities.

Greater gender integration, but decline in women-specific schemes

In the last budget before the national elections, Prime Minister Narendra Modi’s government pitched for transforming “women’s development to women-led development.” Adopted on the evidence-backed premise that gender-neutral policies lead to gender-unequal outcomes, India formally adopted Gender Responsive Budgeting (GRB) in 2005. Every budget since has included a statement that lists out two parts — Part A, which reflects ‘Women Specific Schemes’ which have 100% allocation for women, and Part B, which reflects ‘Pro Women Schemes’ where at least 30% of the allocation is for women.

On Friday, interim finance minister Piyush Goyal proposed to increase the budget allocation for the Mission for Protection and Empowerment for Women from INR 121,961 crore in 2018-19 to INR 131,700 crore for 2019-20, reflecting an overall increase of INR 174 crore. The mainstreaming of gender budgeting across sectors is demonstrable in the fact that more than 70% of beneficiaries of the Pradhan Mantri Mudra Yojana, which offers financial support to small and micro enterprises, were women. Similarly, the Ujjawala Yojana, which has already provided 6 crore free LPG connections, and aims to provide another 2 crore free connections by next year, has a very direct impact on homemakers, especially in rural areas. Further, an increase in budgetary allocation of schemes such as the National Rural Livelihood Mission (INR 4,512 crore), MGNREGA (INR 20,000 crore) and the PM’s employment generation programme (INR 2,327 crore) is also reflected in the gender budget.

The recognition of the cross-cutting nature of gender concerns and their firm integration in fiscal policies is good news. At the same time, it is noteworthy that the budgetary allocation on “women-specific schemes” has declined from INR 4,271.09 crore (budget estimates/BE) to INR 2,573.66 crore (revised estimates/RE) in 2018-19. Hence, an overall increase in the gender budget does necessarily translate into higher spending on women without careful implementation and gender audits.