Author Archives: Dr. Samir Saran

India’s Coal Transition: A Market Case for Decarbonisation

This report was co-authored with Vivan Sharan.

Progress as the world has designed and defined it requires material production which, in turn, requires energy. Historically, therefore, fossil fuels like coal were key in economic growth across geographies. Today the developed economies stand on the edifice of fossil fuels, carbon-intensive industries and lifestyles that have resulted in global warming. The same growth path is now being questioned, and the poor and developing countries are being asked to build, find and fund newer low- and no-carbon models to lift their people out of poverty and achieve their development goals.

Consequently, there are growing calls for India to declare a net-zero year: to offset its carbon emissions by various processes of GHG absorption and removal. India is aware that such calls are irrational, and despite international pressure, has avoided making pledges or setting hard targets, beyond its commitments at the Paris climate conference in 2015. Indeed, “net zero” is not possible with India’s current levels of reliance on coal. Its shift away from this fuel will depend largely on the quantum of additional money and resources that can be invested into alternative energy. However, as global climate finance has both under-performed and been subject to clever redesignation, countries such as India remain in dire need of green financing.

In August 2020, UN Secretary-General António Guterres urged India to give up coal immediately. He asked that the country refrain from making any new thermal power investments after 2020, and criticised its decision to hold auctions for 41 coal blocks earlier that year. Similarly, in March this year, in a message to the Powering Past Coal Alliance Summit, the Secretary-General urged all governments to “end the deadly addiction to coal” by cancelling all global coal projects in the pipeline.[1] Pre-pandemic, India had the second largest pipeline of new coal projects in the world. He also called the phasing out of coal from the electricity sector “the single most important step to get in line with the 1.5-degree goal of the Paris Agreement.”[2]

For much of human history, photosynthesis was the primary source of mechanical energy.[3] Human and animal muscles powered by food and fodder, made the world go around. Photosynthesis was also at the root of heat energy derived from burning wood. Eventually, coal replaced wood as the dominant source of heat energy, but still represented the energy of photosynthesis stockpiled over hundreds of years. The advent of the steam engine in the 17th century helped humans change the heat energy released from coal, to mechanical energy.

This development also upended the paradigm of material production. According to a recent estimate, coal was accounting for well over 90 percent of energy consumption in England by the mid-19th century, owing in large part to the steam engine.[4] For long, researchers had been divided over the question of whether coal was pivotal to the industrial revolution. Scholars such as Wrigley (2010) regarded the switch to coal as a “necessary condition for the industrial revolution,” while others like Mokyr (2009) held that the “Industrial Revolution did not absolutely ‘need’ steam…nor was steam power absolutely dependent on coal.”

A November 2020 paper by Fernihough and O’Rourke might just have settled the question: Using a database of European cities spanning the centuries from 1300 to 1900, the authors found that those located closer to coal fields were more likely to grow faster.[5] Those cities, the researchers wrote, “located 49 km from the nearest coalfield grew 21.1 percent faster after 1750 than cities located 85 km further away.”

It is no wonder then, that in March this year, International Energy Agency (IEA) chief Fatih Birol said it will not be fair to ask developing nations like India to stop using coal without giving international financial assistance to address the economic challenges that will result from such a move.[6] He noted that “many countries, so-called advanced economies, came to this industrialised levels and income levels by using a lot of coal,” and named the United States, Europe, and Japan.

This article explores this line of enquiry by examining the consumption of coal across developed and developing countries, and mapping it against key metrics of energy transition. It finds that countries such as India—with their high dependence on coal and a simultaneous growth spurt in renewables—can be the most effective location for climate finance. This is plausible given that per capita coal consumption in India is still far below that of the developed world, and economic transitions are both inevitable and required to be ‘green’.

To be sure, India is struggling with a coal shortage, which has the potential to derail its post-Covid-19 recovery; the same is true for China.[7] Consequently, there is growing scepticism in developed countries, that both India and China will double down on coal and increase production to overcome supply challenges in the future. While such concerns are not unwarranted, they are not unique to the developing world.

Germany, for instance, in the first six months of 2021 ramped up its coal-based generation, which contributed 27 percent of the country’s electricity demand.[8] Three factors contributed to this rise: increase in energy demand amidst the successive waves of the Covid-19 pandemic, increased prices of natural gas, and reduction in electricity generation from renewable energy (particularly wind.) Coal is often the bedrock of energy generation, and its use is impacted by complex market processes that cannot be reduced to normative choices.

Energy Use and Coal

Countries of the Organisation for Economic Cooperation and Development (OECD) are using progressively less energy to power their societies. Multiple factors can contribute to this trend, at least in theory. First is the technical improvements in energy efficiency – i.e., the use of less energy to perform the same tasks. Second is the “activity effect”, or the changes in energy use because of changes in economic activity. This would also encompass a “structure effect” which relates to changes in the mix of human activities that are prompted by changes in sectoral activity, such as transportation. And finally, there could be weather-related changes in energy use – for instance, more temperate weather can reduce the need for heating or cooling.

The IEA quantifies these effects, and consistently finds that the reduction in energy consumption in the OECD countries is largely a result of technical improvements in energy efficiency. This means that the reduced use of energy in advanced countries is not on account of any significant changes in consumer behaviour—otherwise, the activity effect would be the primary determinant of the fall in energy use. While energy efficiency improvements have driven this fall, the IEA finds that the current rate of improvement is not enough to achieve global climate and sustainability goals. Consequently, the Agency has advocated for “urgent action” to counteract the slowing rate of improvement observed since 2015.[9]

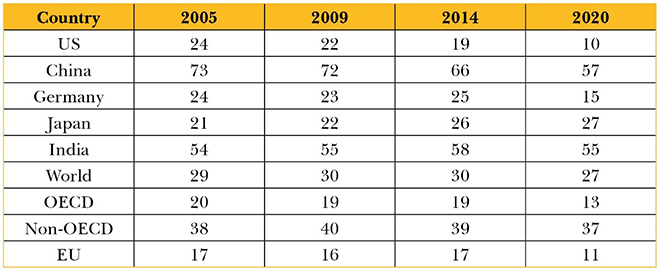

Conversely, developing countries have seen a rapid rise in energy use owing to the activity effect (see Table 1). The increase in economic activity in the developing world is also directly correlated to improvements in life spans and socio-economic progress. While energy use has approximately doubled in countries like India and China from 2005, a large share of global energy efficiency savings is also driven by technical improvements in these countries. However, in the aftermath of the 2008-09 global financial crisis, China implemented a stimulus package that “shifted its manufacturing sector to more energy intensive manufacturing.”[10] A similar trend may emerge in China’s recovery from the pandemic, that may reduce efficiency gains in the future.

Table 1: Total Energy Consumption (Exajoules)

Equity in Coal

It would appear that OECD countries have managed to cut their dependence on coal over the last 15 years quite precipitously. In particular, this seems true of countries like the US and EU members. Japan, meanwhile, is an outlier, having turned to coal to provide base-load power to substitute nuclear energy. In most years between 2005 and 2020, the fall in coal consumption in OECD countries has outpaced the decline in total energy consumption. In 2020, for instance, coal consumption dropped by around 18 percent whereas total energy consumption fell by around eight percent.

While China has begun to reduce its dependence on coal, it still accounts for the largest share of coal consumption among all nations. China is also home to over half of the world’s thermal power plant pipelines – with around 163 GW in pre-construction stage, even discounting the 484GW worth of cancellations since the Conference of Parties at Paris in 2015.[12] China is also one of the last of the biggest providers of public finance for overseas power plants with over 40GW of projects in the pre-construction pipeline.

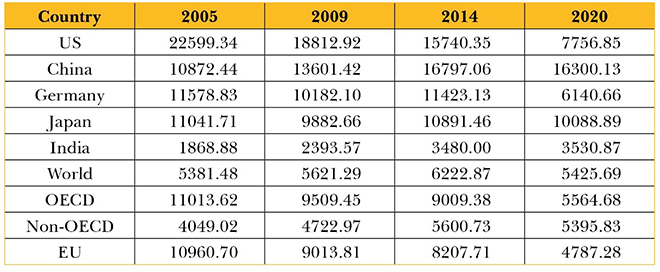

Simultaneously, coal consumption has remained relatively stable at just under 40 percent of primary energy consumption among non-OECD nations (see Table 2). In these countries, coal consumption tends to mirror total energy consumption. India’s dependence on coal has also remained unvarying. These trends suggest that non-OECD countries such as India require to do much more to contribute to a global reduction in coal consumption and therefore towards net-zero GHG emissions. However, there is more to the OECD’s reduced coal consumption than meets the eye.

Table 2: Share of Coal in Primary Energy Consumption (%)

Since the Earth Summit in 1992, India and other developing nations have argued for an equity-based approach to GHG reduction, commensurate with domestic capabilities and historical emissions. This approach has often been subject to cross-examination by OECD experts. For instance, in a 2019 report by the Universal Ecological Fund, high-profile experts including a former White House Adviser and a Harvard professor, ranked national climate commitments based on absolute emission curtailment targets.[13] The report clubbed developed and developing countries together in its assessment of the general insufficiency of climate pledges to meet the Paris Agreement’s goal to keep global warming below 1.5 degrees Celsius above pre-industrialisation levels.[14] This should not be a surprise, however, as it is only in consonance with the overall trend of Western academic discourse seeking to dilute the equity principle.

It is a principle that should not be set aside just yet, given the persistent differences in per capita fossil fuel consumption between the developed and developing worlds. Despite near doubling over 2005-2020, India’s per capita coal consumption is still below the global average (see Table 3). The global average, in turn, has remained static around this period because the decrease in the per capita consumption of coal in OECD countries has been partially offset by an increase in the per capita consumption in non-OECD countries. However, the per capita consumption of coal in OECD countries still exceeds that of non-OECD countries, despite much higher levels of wealth and, therefore, greater capability to transition to renewables and other fuels.

Table 3: Total per capita Coal Consumption (KWh)

Indeed, a large share of the decrease in per capita coal consumption in OECD countries is driven by transition to fuels such as natural gas, that are used to generate electricity, particularly in countries like the US. It accounts for around a 34-percent share of primary energy consumption in the US, and 25 percent in the EU, compared to seven percent in India (and a similar share in China). In contrast, the share of gas in India’s energy mix is among the lowest in the world. Even as Prime Minister Narendra Modi wants to more than double the contribution of natural gas to 15 percent of India’s energy mix by 2030, the Petroleum Secretary has said that the country cannot rely on natural gas.[15] There are several reasons, including high landed costs relative to coal, complex domestic pricing mechanisms, a lack of pipeline infrastructure and stable supply/ import linkages, and the inability of financially stressed electricity distributors to enter into “take or pay” contracts.[16]

India, therefore, requires relatively greater and more aggressive investments in alternative sources of energy than its developed country counterparts that have had decades to transition to fuels like natural gas. Such financial flows to India can prove to be much more effective vehicles for a net-zero trajectory, compared to similar investments in other parts of the world with higher per capita exposure to coal and relatively slower transition pathways to renewables.

Around 72 percent of India’s GHG emissions are linked to its energy sector.[17] It is clear, that if OECD countries are aiming to accelerate a global reduction in GHG emissions, they will need to help India finance its energy transition and overcome the many resource-linked barriers to the wide-scale adoption of renewables. The high costs associated with renewable energy storage and grid upgrade requirements, are related resource challenges. Since developed countries are unlikely to be satisfied with per capita equity, they would do well to help India hurdle some of its obstacles.

Financing Energy Transition

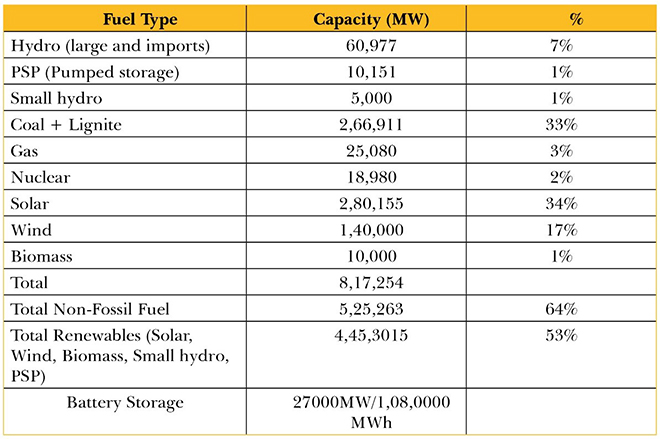

According to India’s Central Electricity Authority’s (CEA) Optimal Generation Capacity Mix, the country’s installed capacity will increase to 817 GW with an additional 27GW of battery storage, by 2029-30 (see Table 4). Of this, firm capacity will contribute approximately 395 GW while renewable sources, around 445 GW. Additionally, a July 2021 study has concluded that more efficient use of existing thermal resources could lead to 50 GW of excess coal capacity with respect to current needs of the system.[18] With limited expectations from nuclear and gas resources and deteriorating coal economics, investments in renewable energy storage options are crucial for managing India’s base load requirements. This requires unlocking of financial and technological flows from the OECD, particularly since there are several uncertainties associated with the cost of battery storage technology. These include risks linked to supply chains and exchange rates.

Table 4: Optimal Electricity Generation Mix (2029-30)

Experts point out that the more renewable energy is introduced into the grid, “the harder and more expensive it will be to use” because of inherent factors such as intermittency.[19] This will need to be offset by investments in a grid that is able to accommodate variable and increased flows of electricity across different regions. The IEA estimates that annual investments in electricity grids will need to “more than double” by 2030 in a conservative scenario where developed countries achieve net zero by 2050, China around 2060, and other emerging and developing economies, by 2070, at the latest.[20] India will also need to explore much wider scale of privatisation of state distribution companies, which now owe generators around USD 20 billion.[21]

The capacity utilisation of India’s coal assets has also witnessed a significant decline over the past decade, with power plants running at 53.37 percent plant load factor (PLF) in FY 2020-21 compared to 77.5 percent in FY 2009-10.[22] Several factors have contributed to this, including the rapidly expanding share of renewable energy generation. India’s coal story is beset with additional challenges including planned decommissioning of older coal plants (approximately 54 GW of coal plants by 2030).[23] Research indicates that the cost of retirement ranges between[24] USD 0.41 – 0.59 million per MW, with older thermal units relatively cheaper to decommission. Consequently, maintaining India’s coal fleet also requires around USD 106 million in investments, to retrofit existing thermal power plants with Flue Gas Desulphurization units. The deadline for doing so has been extended several times in the past decade and has finally been fixed for 2022 for plants located in populous areas.[25] The combination of underutilised coal plants, increasing costs of plant maintenance and reduction in costs of renewables, provides a unique opportunity to galvanise investments and strategic attention towards a low-coal pathway.

The technologies that will pave the way to such low-coal path are developing rapidly, with significant progress in renewables, battery storage, and green hydrogen, among others. They each require, however, large financial outlays. Moreover, India is still highly dependent on expensive bank lending, which is now hitting sectoral exposure limits, whereas long-term capital is required to finance energy infrastructure. As of April 2020, the exposure of banks and non-bank financial institutions to India’s power sector was already around USD 160 billion, roughly the lending necessary to finance the country’s renewable energy targets for 2030. [26]

According to the Government of India’s ‘Energy Compact’ submitted to the UN in September 2021, the country required a total investment of USD 221 billion to set up 450 GW renewable generation capacity, including associated transmission and storage systems.[27] However, other research has pegged this investment much higher at USD 661 billion, to build both renewable energy systems and transmission and distribution systems.[28] The IEA also estimates that India requires a total investment of USD 1.4 trillion for clean technologies to help achieve a sustainable development path till 2040.[29] In comparison, developed countries managed a transition away from coal over a longer period of time and with different costs. Investments for clean energy in the Global South need to be consistently and significantly higher to help achieve the simultaneous goals of SDG 7 (Affordable and Clean Energy) and other development targets.

Advanced countries would do well to recognise that long-term institutional capital is urgently required to help India transition from coal to renewables at scale. What is needed is far more than lip service; nor will change happen only through negotiations at Glasgow at the COP26. Overall, mainstream sources of international climate finance such as the Green Climate Fund and the Global Environment Facility have managed to provide just over a billion dollars in finance for national projects.[30] While there is enthusiasm around green bond financing, the absolute value of issuances towards relevant segments such as renewable energy, is still relatively low at around USD 11.2 billion since 2014.[31] To put it in context, the global issuance of green bonds totalled over USD 305 billion in 2020 alone, specifically for climate-related and sustainability projects.[32]

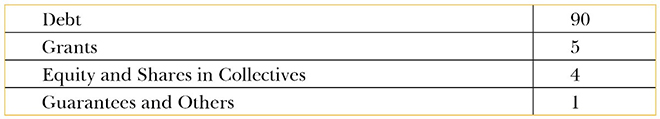

A high sensitivity to the cost of capital means that other sources of institutional capital are needed to fill the gap, even as the Indian private sector learns to raise green bonds and co-develops green taxonomies with relevant parties. Most OECD financing towards renewables in developing countries is conducted through debt instruments. According to the International Renewable Energy Agency, cumulative transactions and financial flows from the OECD countries towards renewables development in the rest of the world reached USD 253 billion between 2009-2019, of which around USD 228 billion was in the form of debt. India accounted for just under USD 11 billion of the amount, which is less than five percent of the cumulative debt finance by OECD countries.

Table 5: Cumulative Transactions by OECD Countries into Renewables (2009-2019, %)

OECD members must aim to redirect institutional investments towards India. For instance, their sovereign funds and pension funds must adjust to new business models around energy storage and distribution. There are also many possible designs of new financial instruments that could be explored. These could recognise the different capacities and capabilities in developing countries at the outset. For instance, grants and debt funding could be combined in multiple ways to subsidise loans. The scale of grant involvement could be directly proportionate to relevant environmental, social and governance factors, and therefore could incentivise more aggressive low-carbon paths. Similarly, new kinds of investment management and rating modalities could be employed to scale up investments where they are most required to offset planetary risks. The availability of innovative long-term finance for India is critical to any meaningful realisation of global net-zero ambitions. India, for its part, must bite the bullet on large-scale power sector reforms, to improve distributional efficiencies and facilitate inward financial and technological flows.

Conclusion

India’s current per capita coal consumption is three-fifths that of the OECD average, and one-fifth that of China’s. This low per-capita coal consumption in a coal-rich country can and must remain the key feature of India’s growth, going forward. This article demonstrates, that for India to keep its coal in the ground, more and better financing is needed.

A market case for a green transition in India already exists. The last few years have demonstrated India’s appetite, among the public and the political class, for a move towards cleaner growth. What it requires now is what this essay calls for: a higher flow of capital towards crucial green sectors—in particular, a higher level of foreign capital inflows towards these sectors, and a better texture of such capital, moving towards a more patient and equitable finance.

This brief was first published in ORF’s monograph, Shaping Our Green Future: Pathways and Policies for a Net-Zero Transformation, November 2021.

Vivan Sharan is a Visiting Fellow at ORF.

Samir Saran is the President of ORF.

Endnotes

[1] “UN Chief Calls for Immediate Global Action to Phase Out Coal”. Unfccc.int. UN, March 2, 2021.

[2] T. Jayaraman, and Tejal Kanitkar. “Reject This Inequitable Climate Proposal.” The Hindu. The Hindu, September 18, 2020.

[3] Tony Wrigley. “The Industrial Revolution as an Energy Revolution.” VOX, CEPR Policy Portal, July 22, 2011.

[4] Wrigley, “The Industrial Revolution as an Energy Revolution”, 2011

[5] Alan Fernihough and Kevin Hjortshøj O’Rourke. “Coal and the European Industrial Revolution,” The Economic Journal, November 4, 2020.

[6] “IEA Chief Backs India on Coal, Says No Exit without Financial Support,” The Economic Times, March 3, 2021.

[7] Laura He and Manveena Suri. “China and India Face a Deepening Energy Crunch,” CNN, October 12, 2021.

[8] Deutsche Welle. “Germany: Coal Tops Wind as Primary Electricity Source,” DW.COM, September 13, 2021.

[9] “Energy Efficiency 2020,” IEA, 2020.

[10] “Energy Efficiency 2020”, 2020

[11] “Statistical Review of World Energy 2021,” BP, 2021.

[12] “China: Home to over Half the World’s Coal Pipeline,” E3G, September 14, 2021.

[13] “The Truth behind the Climate Pledges,” FEUUS, n.d.,

[14] This goal requires a 50-percent reduction in global GHG emissions by 2030.

[15] “High Prices Could Slow India’s Transition to Gas,” The Economic Times, October 20, 2021.

[16] M. Ramesh, “Why Gas Is Not Just Hot Air,” The Hindu BusinessLine, May 30, 2021.

[17] Angela Picciariello, Sarah Colenbrander, Amir Bazaz, and Rathin Roy, “The Costs of Climate Change in India – Cdn.odi.org.” ODI, June 2021.

[18] Karthik Ganesan and Danwant Narayanaswamy, “Coal Power’s Trilemma,” CEEW, July 2021.

[19] Jonathan Kay, “Tangled Wires: Preparing India’s Power Sector for the Clean Energy Transition,” Carnegie Endowment for International Peace, August 4, 2021.

[20] “Financing Clean Energy Transitions in Emerging and …” IEA. IEA, 2020.

[21] IEA, “Financing Clean Energy Transitions in Emerging and …”, 2021

[22] “Power Sector at a Glance ALL INDIA.” Ministry of Power, October 21, 2021.

[23] Aditya Lolla, “India – Peaking Coal?” Ember, February 16, 2021.

[24] Vaibhav Pratap Singh and Nikhil Sharma, “Mapping Costs for Early Coal Decommissioning in India …” CEEW, July 2021.

[25] “Flue Gas Desulphurisation: A Rs 80,000 Crore Investment Opportunity,” The Financial Express, June 11, 2020.

[26] Alan Yu, Kanika Chawla, and Rita Cliffton, “Renewed U.s.-India Climate Cooperation,” Centre for American Progress, February 18, 2021.

[27] “SDG7 Energy Compact of the Government of India … – Un.org.” UN, September 22, 2021.

[28] Rohit Gadre, Atin Jain, Shantanu Jaiswal, Vandana Gombar, and Dario Traum, “India’s Clean Power Revolution.” Bloomberg, June 26, 2021.

[29] “India Energy Outlook 2021,” IEA. IEA, 2021.

[30] “GCF Data- Interactive Map on Programme and Project-Level Data by Country,” Unfccc.int. UNFCCC, n.d.; “India at a Glance,” Global Environment Facility, August 24, 2016.

[31] Shreyas Garg, Rishabh Jain, and Gagan Sidhu, “Financing India’s Energy Transition through International …” CEEW. CEEW, August 2021.

[32] Mark D. Holmes and Elena Millerma, “Energy Transition: How to Finance the Race to Net-Zero,” White & Case LLP, August 5, 2021.

Building Back Better together—Potential for an India-UK partnership for a Green Transition

This article was co-authored by Terri Chapman

While many have pinned their hopes on technology to solve the looming challenges posed by climate change, it is clear that this alone may not be the silver bullet, and other processes will have to be invested into. For example, one of the most ambitious technological efforts to date is the Climeworks Orca plant that was launched in Iceland last month. The plant is illustrative of the inadequacy of the hunt for the technology elixir. The plant can remove 4,000 tons of CO2 a year, which is equivalent to the annual emission from just 800 cars. To scale this up and make it accessible to different geographies is the hurdle for such innovation. The timelines to do this are incompatible with the urgency of responding to global warming.

It is time to do what we have known needs to be done for decades—which is to reduce greenhouse gas emissions. These reductions are complicated by the fact that industrialisation is still underway in much of the world. Countries in the global South rightly seek space to grow. However, the template for that development—backed and funded by international financial institutions—is heavily reliant on high-emitting activities with only limited finance being deployed towards cleaner and greener options. At the same time, countries of the global North are dragging their feet and, in some cases, still peddling the idea that climate change can be responded to without dramatic changes in consumption patterns or significant financial reconfiguration. The “blah, blah, blah,” approach to climate change described by Greta Thunberg, is as she says, not working. Instead, countries around the world, especially high-income countries, must realise that they cannot negotiate or talk their way out of the climate mess created by them. Instead, it is time to get their political approach right and to deploy the largest quantum of financial resources ever mobilised to enable equitable green transitions. And there is another complication; this climate war chest will have to be invested into developing countries, which challenges the credit risks and cost of capital logic that have defined the post-War financial flows.

Countries of the global North are dragging their feet and, in some cases, still peddling the idea that climate change can be responded to without dramatic changes in consumption patterns or significant financial reconfiguration.

The COVID-19 pandemic has created renewed opportunities and invigorated the demand to make our cities healthier, make our social protection systems more robust, make our societies more equitable, and to respond to climate change meaningfully. More people now get what “systemic risk” means and the devastation caused by the pandemic should make governments more eager to address such risks.

The United Kingdom (UK) and India are well placed to respond to these new opportunities as partners and to craft a road map together for Glasgow and beyond. This is a partnership with much merit. The leadership for green transitions is coming from countries like India (the only G-20 country living up to its ‘2 degree’ commitments made at Paris) even as control over capital and technology resides in developed countries like the UK. Leveraging their specific roles and strengths, the UK and India can work together as partners in three areas in particular. These include human capital development, climate finance and funding of clean energy and infrastructure, and green and smart manufacturing.

Partnership in higher education

The UK is a global leader in education, knowledge, innovation, and research, while India is one of the largest consumers of higher education and is a market for research and innovation. Higher education enrollment, for example, has tripled over the last 20 years in India but remains at just 28 percent. The opportunity is defined by a simple fact—nearly half of India’s population is below the age of 25 and that demand for higher education is likely to increase. As a result, there is significant demand for UK education opportunities in India. In 2019, more than 37,500 Tier 4 student visas were given to Indian students studying in the UK. While this is a large number of students, in the larger context, it is insignificant and amounts to very little beyond building and nourishing an Oxbridge community in India.

Efforts under the new policy could create greater access to high-quality higher education in India, deepen UK–India academic and scientific collaborations, and create new research initiatives and more significant innovation.

India’s New Education Policy 2020 makes it easier and more attractive for foreign universities to establish branch campuses in India. Efforts under the new policy could create greater access to high-quality higher education in India, deepen UK–India academic and scientific collaborations, and create new research initiatives and more significant innovation. All of these can support broader efforts to foster human capital, skills, and knowledge in India, which are needed to transition towards a more sustainable, knowledge-based economy. UK institutions must re-calibrate their global role by investing in overseas markets and partnering to build the campuses of the future in the geographies that matter. Human capital and research efforts in India will enable innovation and work forces, which will be deployed at the frontlines of global climate and development efforts.

Partnership in finance

The second area of potential for the UK–India partnership is finance. Mitigating climate change will require enormous financial investments. This is much larger than the US $100 billion annual commitment made by the Annex II countries. For example, just for meeting its renewable energy targets by 2030, India will require around US $2.5 trillion dollars. The common but differentiated responsibility for financing green transitions posits that industrialised countries must contribute to (small amounts) and help catalyse large financial flows towards this ambition of New Delhi. However, many are falling behind even on their abysmally small commitments. Unless these trillions of dollars can flow to India and other developing countries, we will lose the climate battle and what unfolds will be unpredictable and consequential.

There are significant and unrealised opportunities for investment in ‘green transitions’ more broadly and at retail scale. Unfortunately, financial institutions are only modest actors in the green spaces in India. Transformative interventions at scale will require new thinking, innovative financial products and more favourable borrowing terms. It will be a crime against humanity if the country with the largest potential to curtail future emissions borrows money from the developed world at exorbitant rates. If Climate Risk is seen as a clear and present danger, cost of funding for climate mitigation projects must remain the same across continents.

Transformative interventions at scale will require new thinking, innovative financial products and more favourable borrowing terms.

The Indian Railway Finance Corporation (IRFC) issuance of climate bonds in 2017 is illustrative of the potential. The bond raised US $500 million from investors around the world. Municipal bodies in India, including the Indore Municipal Corporation (IMC), are also considering raising ‘green masala bonds’ to fund climate responsive projects. Green bonds offer an opportunity for countries like India to access new pools of international funding for green projects, for which there appears to be demand in the UK. In September, the UK issued its first sovereign green bond, raising 10 billion GBP, with demand of nearly 90 billion GBP, indicating the magnitude of appetite for such investments.

Additionally, regulations and perverse laws will have to make way and allow pension and insurance funds to invest into emerging economies that are the ground zero of the climate battle. These funds hold the largest global savings, mostly derived from fossil fuel age businesses and there is justice in their being the patient capital that is deployed in building clean and green infrastructure in emerging and developing economies. Retail finance needs innovation too. Buying a solar facility for rooftops in any market must be at a discount (financial costs) to the credit available for purchase of cars and air-conditioners. Bulk finance and retail finance have not yet signed the Paris Agreement; can London and New Delhi partner to change this?

Partnership in green manufacturing and value chains

The third opportunity is around supporting green and smart manufacturing and green value chains. Again, the pandemic has revealed the risks of over-dependence on any single country to supply critical goods. China, for example, owns the largest solar and wind manufacturing companies. India offers an alternative and an opportunity to diversify supply chains and make them more resilient. This is a chance to invest in and build up India’s smart and green manufacturing capabilities and create more robust supply chains for renewables and other green technologies. The R&D and innovation out of the UK has recently served only Beijing. It is time to rethink this monochromatic value chain. An India and UK innovation and smart manufacturing bridge is needed. The potential of such collaboration is illustrated by the AstraZeneca vaccine, for which R&D took place in the UK, with mass manufacturing in India at the Serum Institute of India – the world’s largest vaccine producer. India is also ramping up its green production and manufacturing capabilities in areas such as hydrogen production and the manufacturing of next generation battery technologies to support green transitions. Indian companies are scouting for partnerships; and it is time to put some political weight behind it. The Build Back Better World and the Quad and the EU and India partnership all support this.

India is also ramping up its green production and manufacturing capabilities in areas such as hydrogen production and the manufacturing of next generation battery technologies to support green transitions.

We must act to save lives, improve health, protect livelihoods, and safeguard resources for current and future generations. But the single most important motivation has to be the collective will to improve the lives of billions who have been excluded from the economic mainstream and, indeed, from any access to dignity and livelihoods. These constitute the largest cohort on the planet and their continued misery must not underwrite the green-tinted splurges of the rich world. The UK and India are in a position not just to act but to act as partners to change this.

The supply of COVID-19 vaccines has improved, but has demand for it saturated in India?

This article was co-authored with Oommen C. Kurian

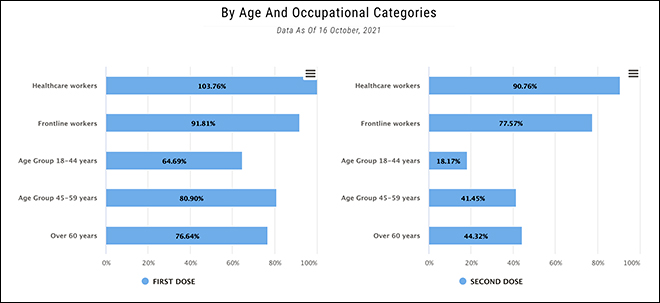

Latest available data indicates that India has administered 699.6 million first doses and 286.3 million second doses of COVID-19 vaccines to its adult population. The coverage is markedly higher amongst the 45+ population (Graph 1), with about 80 percent within the age group having received at least one dose, and more than 40 percent fully vaccinated. The Government of India’s goal is to vaccinate all adults against COVID-19 by 31 December 2021, and therefore, the pace of vaccination in the last quarter is of importance.

Graph 1: Vaccination Coverage Across Age and Occupational Categories

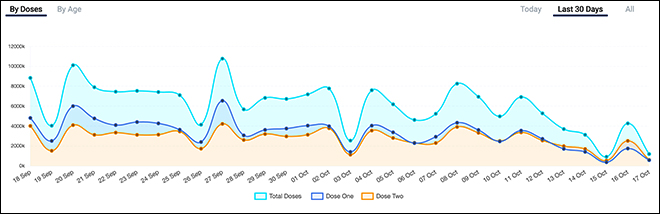

The numbers in the recent weeks have been disappointing. Instead of accelerating to the required average daily vaccination rate of more than 11 million per day (required on October 1), the number of daily vaccine doses administered has shown a stagnation and, indeed, a decline. From 8.2 million doses on 8 October, the daily numbers have declined considerably, taking down the seven-day moving average from 6 million per day to 3.9 million per day on 18 October. While the festivities across the country may be part of the explanation, there are clearly other factors at play, which may undermine the 31 December target that the Government of India has set for itself. This, therefore, needs to be explored in-depth; the possible reasons behind such a surprising slowdown in the vaccine uptake uncovered and remedial measures instituted need to be examined.

Graph 2: Number of Vaccine Doses Administered per Day

Is the decline in numbers due to supply constraints?

While it is a legitimate question to ask, given the history of delays in capacity ramp up for different vaccines in India, this does not seem to be the driver of the slowdown. A look at the unutilised vaccine doses still available within the vaccine cold-chain—the difference between doses supplied to the states and those administered—strongly points to this. A weekly analysis of the available doses with the states (Graph 3) shows that there is substantial build-up of vaccine inventory at the state level. During a month between 15 September and 14 October, the doses available with states almost doubled from 46.3 million to 88.9 million. The data made available on 18 October indicates that there are currently 107.2 million doses awaiting to be administered at the states and union territories. This trend indicates one possibility: There is a strong tapering off of demand for COVID-19 vaccines.

Earlier this year, at the beginning of the vaccination drive, when both number of cases and deaths were low, there was a distinct lack of demand for vaccines, which shot up only with the surge in cases. However, with more than 70 percent adult Indians already vaccinated with one dose, this may not be the major contributor. Demand may be flagging as many Indian states may have already reached almost all of the “willing” adults with one dose at least. Perhaps the undecided and the ‘vaccine hesitants’ are now the ones left and the tapering of numbers could be an outcome of this.

Graph 3: Weekly Analysis of Doses Available in the State-level Cold Chains

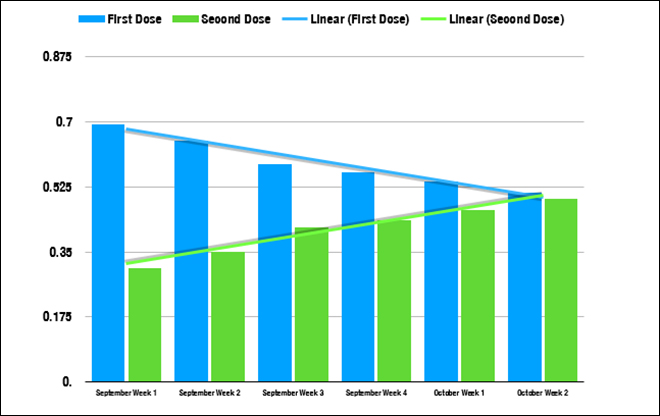

Weekly vaccination data disaggregated by doses from the 1st of September onwards (Graph 4) underlines this possibility. As a proportion of the weekly doses, first doses are on a clear decline over the last six weeks. In the first week of September, first doses constituted almost 70 percent of total vaccinations, but in the second week of October, it was just over 50 percent. This could only mean that the vaccination drive in many parts of the country may have already reached the easy-to-reach population. Vaccinating all of the remaining 30 percent or so of adult Indians will require additional efforts from the government, local leaders, and civil society.

Graph 4: Proportion of Weekly First and Second Doses

Towards herd immunity: the last mile will be the hardest

In the third week of October so far, second doses have outstripped first doses by a big margin. Between 14th and 18th October, of the total 14.8 million doses administered in India, only 6.3 million were (42 percent) first doses, showing clearly that the second doses are now driving the overall numbers. With the offer of free vaccine for all adult citizens, the Government of India has removed financial access barriers from the picture. However, for many sub-populations, physical access to vaccination centres may be difficult for a range of reasons. Vaccine hesitancy will also be a problem in a small but significant proportion of the population. To overcome these, the government must run the vaccination drive in surgical mode, focusing on communication, community engagement and hard-to-reach populations. Many states are already deploying mobile vaccination teams to take vaccines to the people in the margins, with success.

At the same time, the centre and state governments must now focus on district-level champions to win the battle of perception, and to take vaccines to the constituency that is the most difficult to reach—those hesitant to take vaccines. That many of them may be highly vulnerable to COVID-19 due to age or comorbidities makes such an initiative an ethical imperative. In short, first doses are drying up across the country, which could be either due to access-related issues or vaccine hesitancy. India needs district level mop-up operations. The vaccination drive’s initial phases leveraged technology in a big way, but the last mile needs to leverage communities and personalities alongside technology. Many countries are finding ways to nudge and even push the citizenry towards COVID-19 vaccination, focusing on employers and travellers. Canada, for example, is planning to place unvaccinated government employees on unpaid leave and has also made COVID-19 shots mandatory for air, train, and ship passengers.

The vaccination drive’s initial phases leveraged technology in a big way, but the last mile needs to leverage communities and personalities alongside technology. Many countries are finding ways to nudge and even push the citizenry towards COVID-19 vaccination, focusing on employers and travellers. Canada, for example, is planning to place unvaccinated government employees on unpaid leave and has also made COVID-19 shots mandatory for air, train, and ship passengers.

Throughout the pandemic, India has had one of the highest proportions of population willing to be vaccinated when compared with other countries. For the same reason, a smart communication campaign should do in India what vaccine mandates are failing to do in many other countries. With almost 100 crore vaccine doses administered, and a robust information backbone tracking tests, vaccinations and cases, it should not be difficult to convince those still doubtful about the efficacy or the safety of vaccines. Popular personalities, political and religious leaders, and civil society organisations should be engaged actively to take evidence-based messaging to the district level, particularly in those areas where vaccine uptake remains low. Given the deceleration in vaccination we observed over the last few days, it is easy for India to be in a situation where vaccine doses to meet the 31 December target are available but demand becomes the binding constraint.